There's no need to say that an accurate financial reporting process is an integral part of any successful business. Financial reporting helps prepare and present financial statements to management, stakeholders, and regulatory authorities. It shows how a business is doing financially, which helps the management and investors make smart decisions. In a fast-paced business environment, companies move from balance sheets to real-time reports to be ahead of competitors and estimate the market and business position on the market.

The Software Development Process Makes Accurate Financial Reporting in Business

Accurate financial reporting helps businesses identify areas of strength and weaknesses, attract investors, and secure funding. Let's not forget the regulatory authorities, which require businesses to submit financial statements regularly, to ensure compliance with financial reporting standards.

If you made up your mind to develop the software for financial reporting, you should be aware that the development process involves several stages, including planning, analysis, design, development, testing, deployment, and maintenance. It's vital to understand each stage before starting to build the software for your business:

- The planning stage. It's when the software development team identifies the business requirements for financial reporting software. The team analyzes the existing financial reporting process, identifies areas for improvement, and develops a plan for the development process;

- The Analysis stage means the professional team gathers and analyzes data from the existing financial reporting process. The team identifies the data sources, data flow, and data processing requirements for the financial reporting software;

- The Design stage. The software development team designs the architecture of the financial reporting software. The team develops the data model, database schema, and user interface for the financial reporting software;

- The Development stage covers the financial reporting software development. The team writes code, integrates data sources, and develops the user interface;

- The Testing stage, it’s when your team tests financial reporting software to ensure that it meets the business requirements;

- The Deployment test. Your developers deploy the software to the production environment and provide training and support to end users;

- The Maintenance stage is about ongoing support and maintenance for the software, including bug fixes, updates, and enhancements.

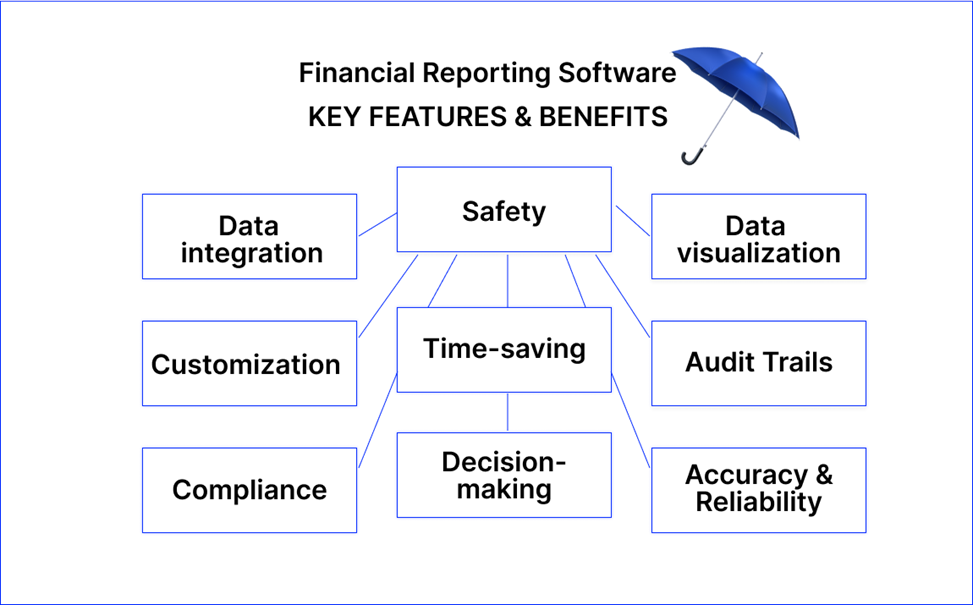

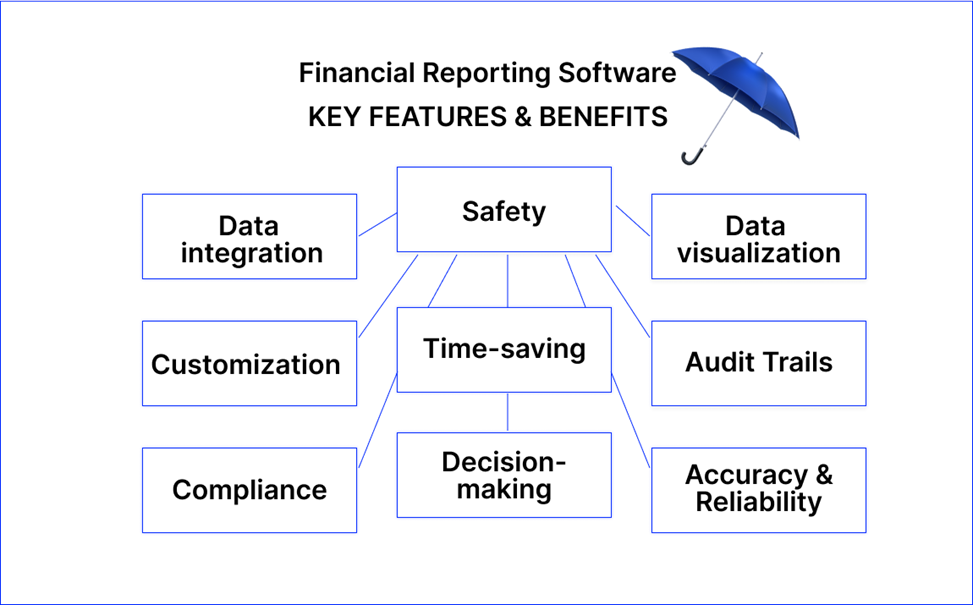

Key Features of Financial Reporting Software and its benefits

Overall, more and more businesses have started designing software to automate and streamline the financial reporting process to make it flawless, i.e. accurate. Let's name the key features and benefits you can get by entering the new phase of your business development:

Data integration - the ability to collect and consolidate financial data from multiple sources such as accounting software, spreadsheets, and databases;

Customization - the ability to create custom reports tailored to specific requirements:

- Balance sheets;

- Income Statements;

- Cash Flow Statements;

- Profit and loss statements;

- Financial Ratios and many others;

Data visualization - the ability to present financial data in a visually appealing and easy-to-understand format such as charts, graphs, and dashboards;

Audit trails - the ability to track changes made to financial data and provide a history of the reporting process;

Safety – the ability of your software to provide a secure and safe way to store your confidential data thanks to password protection and data encryption.

With accurate and up-to-date information at your fingertips, you can track the success of your strategies and make adjustments to ensure your business overtakes your competitors.

The benefits of using financial reporting software are obvious:

- Increased accuracy and reliability - financial reporting software reduces the risk of errors and improves the accuracy and reliability of financial reports;

- Time savings - financial reporting software automates manual tasks, reducing the time and effort required to generate financial reports;

- Better decision-making - financial reporting software provides real-time insights into financial performance and current business situation;

- Compliance - financial reporting software helps businesses comply with financial regulations and standards.

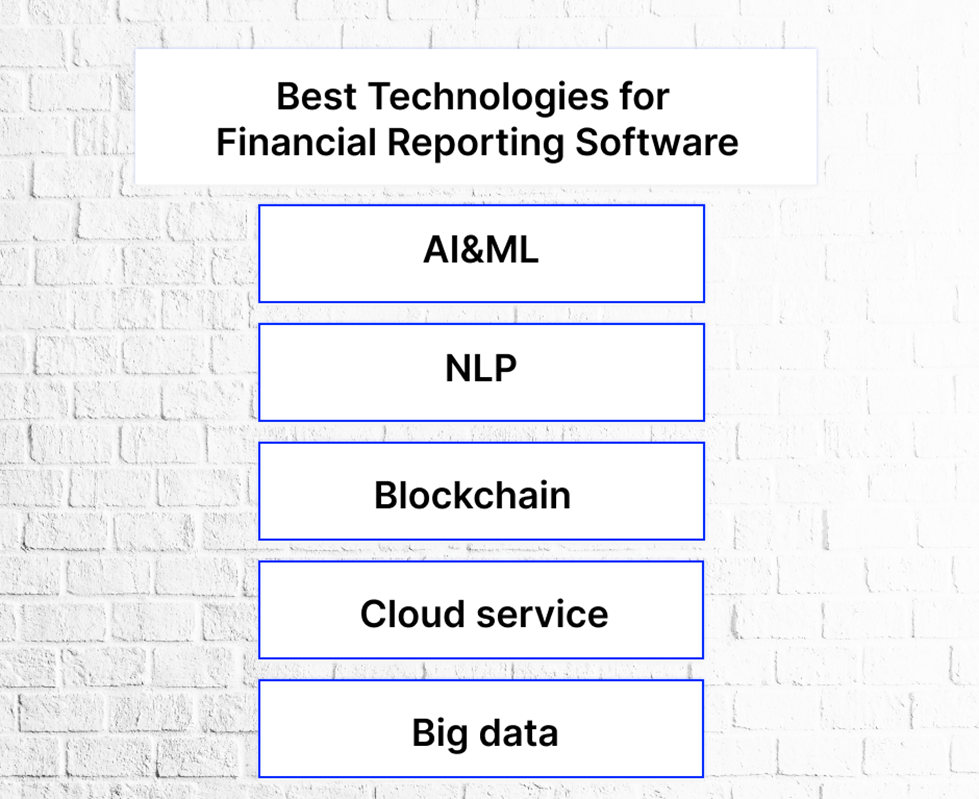

Which technologies use financial reporting software?

As the need for openness and on-time reporting grows, so do the technologies developers use to ensure your software is reliable. With the ever-increasing complexity of financial reporting requirements, companies must stay ahead of the curve to remain competitive. Technology can be a key tool to help businesses stay in compliance and maximize efficiency. Here are some of the most promising emerging technologies in this field:

- Artificial intelligence (AI) and Machine learning (ML): AI and ML can help financial reporting software developers create more accurate and comprehensive reports by identifying patterns and trends in data. Artificial intelligence is a technology that enables machines to learn from experience and perform tasks that would typically require human intelligence, such as speech recognition and decision-making. In financial reporting software development, AI analyzes large amounts of data quickly and accurately. AI-powered software can identify patterns and trends in financial data, detect anomalies, and provide insights into a company's financial performance.

Machine learning is a subset of AI that enables machines to learn and improve from experience without being explicitly programmed. ML trains machines to recognize patterns in financial data and automate tasks such as data entry and reconciliation, reducing the risk of errors and improving efficiency.

- Natural language processing (NLP): NLP technology can help financial reporting software interpret unstructured data, such as text from annual reports or news articles, to generate otherwise unavailable insights.

- Blockchain: Blockchain is a distributed database technology that has the potential to revolutionize financial reporting by providing a tamper-proof record of transactions.

- Cloud computing: Cloud-based financial reporting software provides real-time visibility into a company's finances, making it easier to identify issues. It can also automate repetitive tasks, improve collaboration among team members, and provide real-time insights into a company's financial performance.

- Big data: Financial reporting software development must be able to handle ever-increasing amounts of data, which can be made possible through big data technologies.

Challenges in Developing Financial Reporting Software

It's really challenging to meet the high standards of accuracy and reliability required in the financial industry. Businesses demand more from developers to pace the growing market. So, you know, there are several challenges that developers must take into account in order to create a successful financial reporting software product.

One of the primary challenges in developing is managing the vast amount of data that needs to be processed. The data needs to be organized, structured, and analyzed in a way useful for decision-making. In addition, the data must be secure and protected from unauthorized access or theft.

To overcome this challenge, financial reporting software developers must ensure that their software can handle large amounts of data efficiently. They must also incorporate features that ensure the security of the data, such as encryption and access controls.

- Integration with Existing Systems

Another challenge in developing financial reporting software is integrating it with existing systems. Many organizations already have systems in place that are used for financial reporting, and integrating new software can be a challenge. The software must be able to communicate with existing systems and databases seamlessly.

Financial reporting software developers must ensure that their software is designed to integrate with existing systems. They must also provide tools and resources to help businesses migrate their data from existing systems to the new software.

Compliance with regulatory requirements is a critical aspect of financial reporting. Organizations must comply with regulations, such as GAAP, IFRS, and SEC regulations, to ensure that their financial statements are accurate and transparent.

So, developers must ensure their software complies with relevant regulatory requirements. They must also provide tools and features that enable organizations to generate reports that comply with these regulations.

The user interface design is an essential aspect of financial reporting software. The software must be intuitive and easy to use to ensure that users can navigate it easily and complete their tasks efficiently.

To get around this problem, the business needs to put money into making an interface that is easy to understand and use. Developers must conduct usability tests to ensure that the software is easy to use and meets the needs of its users.

- Cost and Time Constraints

Developing financial reporting software can be a time-consuming and costly process. The business will have to invest in the software's development, implementation, and training of users to ensure its successful adoption.

To overcome this challenge, the development team must build cost-effective and scalable software. It must also provide training and support to users to ensure they can use the software efficiently and effectively.

Best Practices for Financial Reporting Software Development

At the heart of any successful business is accurate and timely financial reporting. The ability to monitor and analyze financial data is critical for developing strategies, and achieving long-term success, so let's name here the best practices that our customers follow:

- User-centered Design

User-centered design is one of the most important aspects of financial reporting software development. User-centered design is an approach that places the needs, goals, and preferences of the end user at the center of the design process. By adopting a user-centered design approach, software developers can ensure that the financial reporting software is intuitive, easy to use, and meets the needs of its users.

Additionally, user-centered design requires a focus on usability testing and feedback.

- The Agile Development Methodology

The Agile development methodology is a flexible, iterative way to make software that emphasizes collaboration, quick prototyping, and always getting better. This method is especially good for making software for financial reporting because it lets developers respond quickly to changing business and user needs. Also, it is iterative, and developers can quickly find and fix problems, making the product more stable and reliable.

Agile development methodology involves breaking down software development into small, manageable tasks that can be completed quickly. These tasks are then prioritized based on business needs and user requirements. Developers work in short cycles, typically two to four weeks, and continually seek end-user feedback to ensure that the software meets their needs.

- Focus on Continuous Improvement

Financial reporting software development is an ongoing process that requires a commitment to continuous improvement. To achieve continuous improvement, companies must establish a process for regularly reviewing and updating their financial reporting software. This process includes regular software updates, bug fixes, and feature enhancements. Additionally, companies must ensure that their software development team is well-equipped to handle ongoing maintenance and support.

Continuous improvement requires a culture of innovation and a willingness to experiment with new ideas and technologies. Be willing to spend money on research and development to stay ahead of the curve and give their end users the best and most advanced financial reporting software.

- Collaboration Between Development and Finance Teams

Finally, successful financial reporting software development requires close collaboration between the development and finance teams. Collaboration between the development and finance teams requires effective communication and a shared understanding of business objectives and priorities. Developers must be able to understand and interpret the financial data that will be processed by the software, while the finance team must be able to provide clear guidance on the features and functionalities required.

By working together, the development and finance teams can ensure that the financial reporting software meets the highest accuracy, reliability, and usability standards. That’s what we offer to our customers: software development services that will allow embracing the right position on the market.

Why the Business World Moved from Balance Sheets to Real-Time Reports

We hope you've understood why financial reporting software has numerous benefits that can help businesses improve their reporting practices. This software helps businesses streamline their financial reporting processes, eliminate manual errors, and reduce the time spent on preparing financial reports. This, in turn, frees up resources that can be utilized to focus on other critical areas of the business, such as innovation, research and development, and marketing.

In addition, financial reporting software provides businesses with a comprehensive view of their financial performance, allowing them to identify areas that require improvement and make informed decisions: reduce costs, improve cash flow, and increase revenue, leading to growth and improved profitability. We have no doubts that the future of financial reporting software development looks bright as the demand for accurate and timely financial information grows.

The advancement of technology, such as machine learning, artificial intelligence, blockchain, natural language processing, and data analytics, will further revolutionize financial reporting software. These technologies will enable businesses to quickly analyze large amounts of data, automate routine tasks, and provide predictive insights.

The use of cloud-based financial reporting software is also becoming increasingly popular, allowing businesses to access their financial information from anywhere, at any time. This flexibility can improve collaboration among team members and stakeholders.

As technology advances, we can expect to see more sophisticated financial reporting. Therefore, businesses must invest in software development to feel confident in the future.

.png)