It’s already 2022 but we still can’t forget 2020. That year has been a very challenging year for most industries and FinTech is no exception. However, the FinTech industry appears to have weathered a storm that continues to ravage the globe.

State of the FinTech market

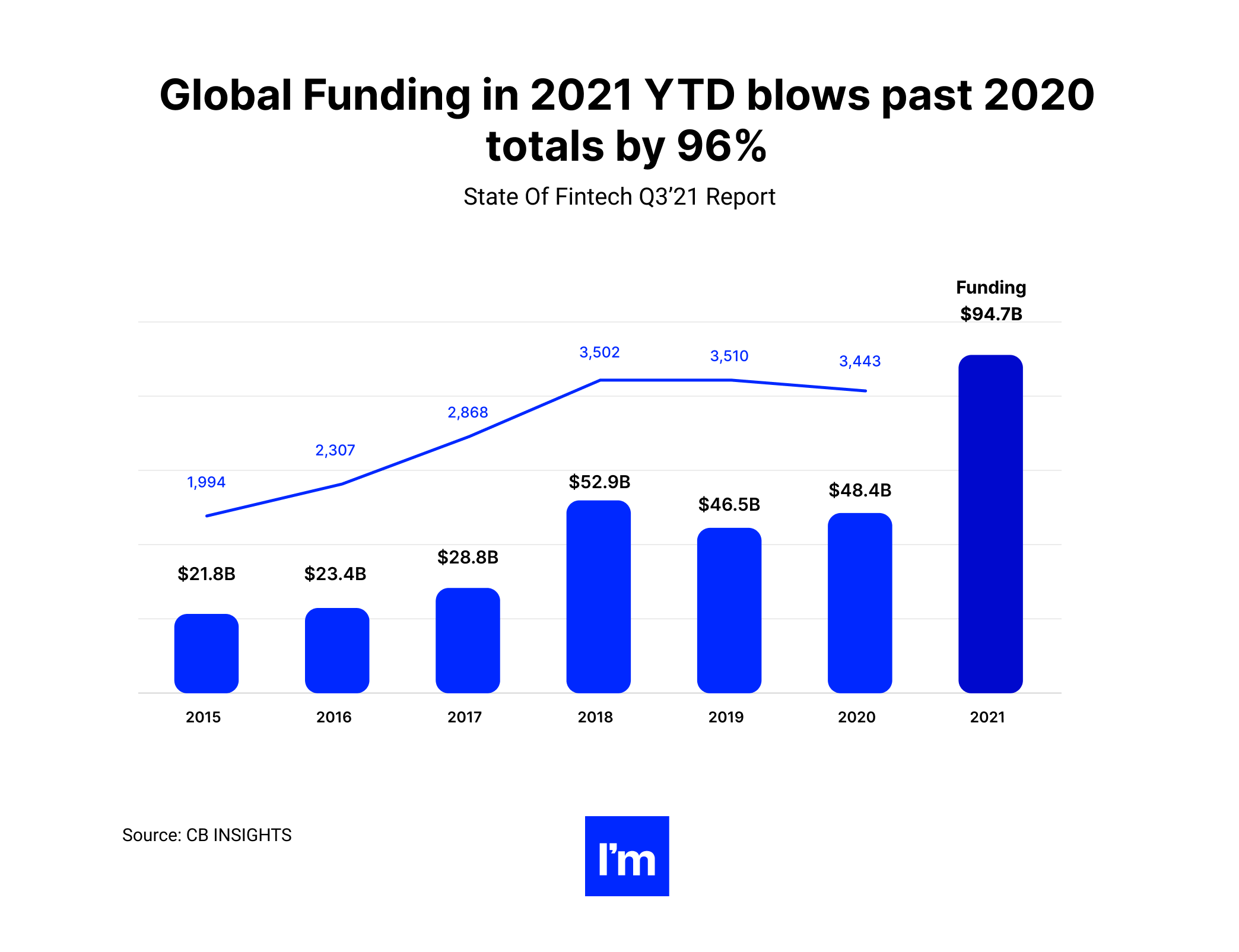

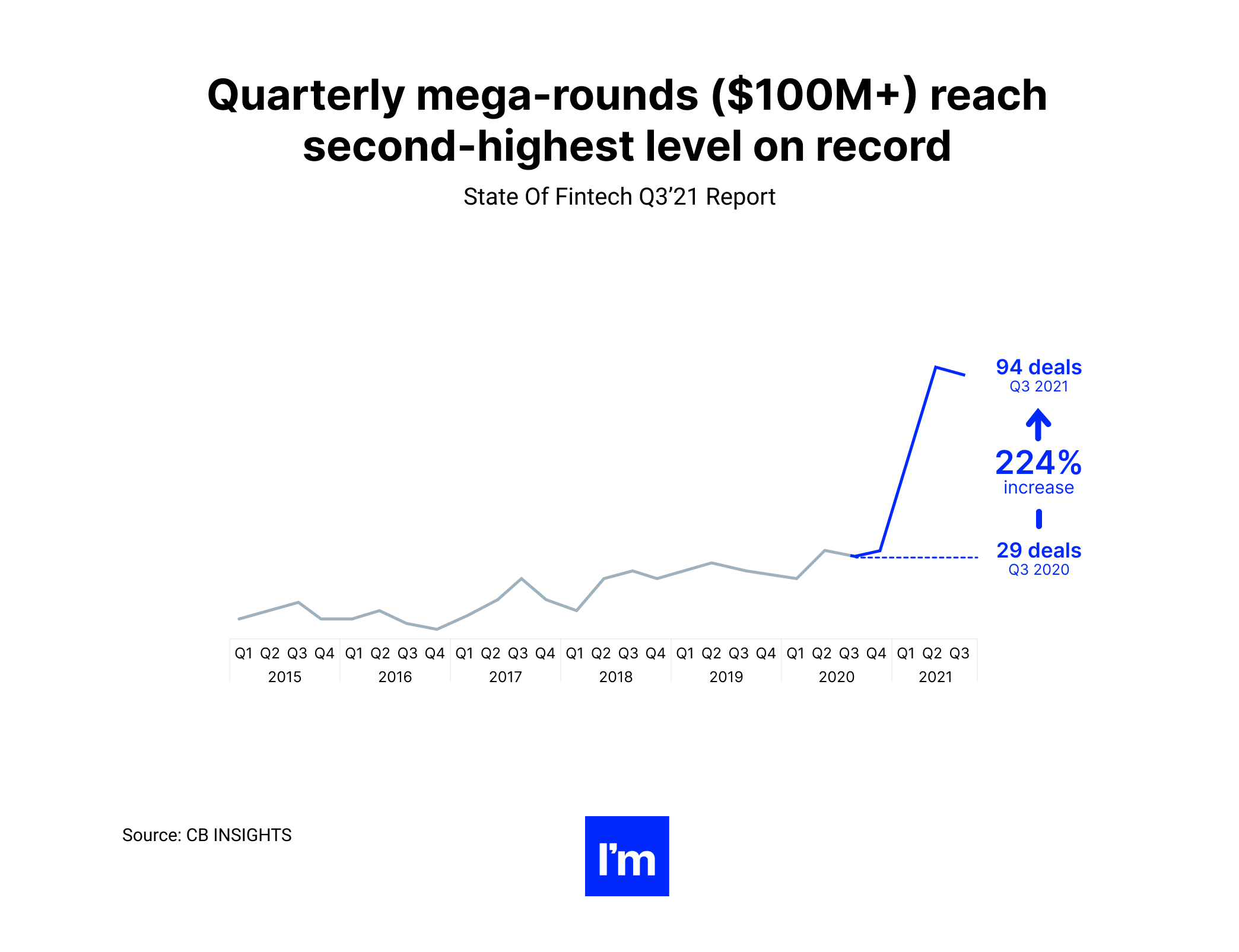

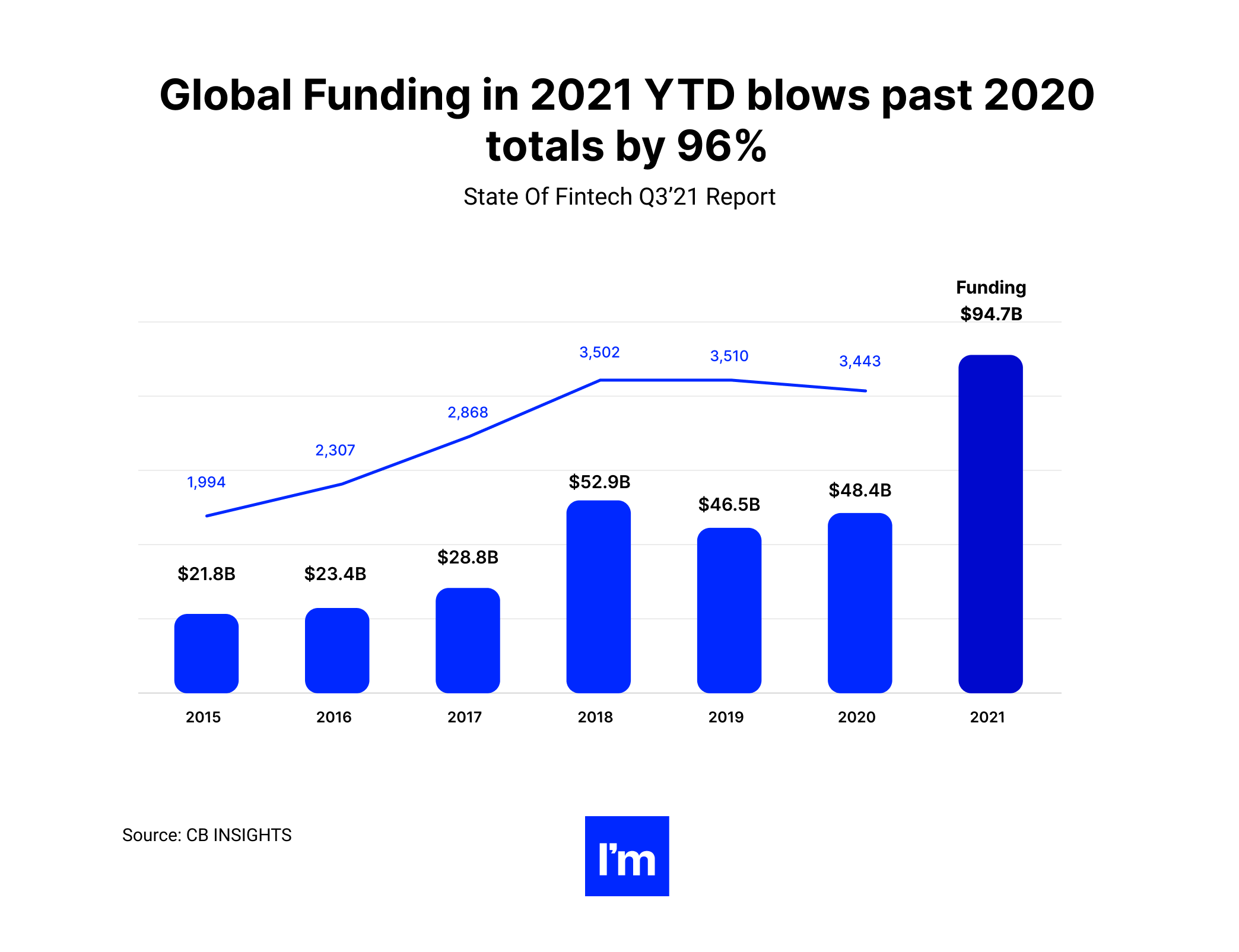

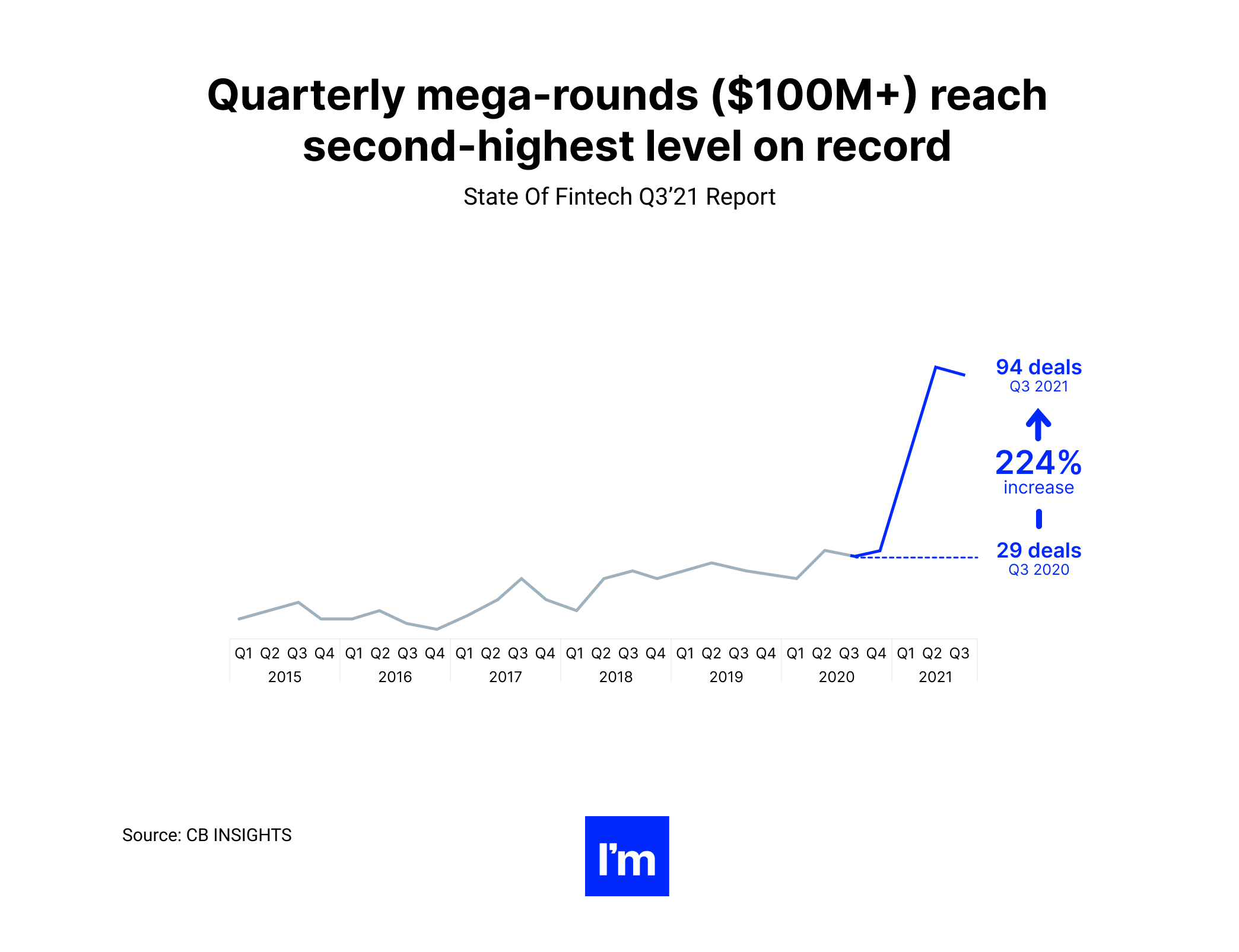

Talking about these days, the FinTech sector is booming, with global funding hitting a record $91.5 billion this year - nearly double its total in 2020. Last quarter, 42 FinTech unicorns (startups worth over $1 billion) were born, bringing the total to 200 for the year, according to the State Of FinTech Q3 '21 Report.

The CB Insights report shows Tiger Global Management and Coinbase Ventures lead FinTech investors with 24 and 22 deals in the third quarter, respectively. The US remains the region with the largest number of FinTech deals, with 38% of global FinTech deals in the last quarter, followed by Asia with 26%.

From the below graph you can find out who is the leader, from startups watching the best deals to regions with the greatest financial boom.

The next picture shows us which companies have the largest funding rounds in Q3 ’21 by transaction stage, geography, and sector.

Young businessmen are just beginning to understand that there are unicorns in every major country - worldwide known experts are sure that in any country with a population of over 100 million people, soon there will be a unicorn in the financial technology industry as well.

Can’t wait to see how FinTech makes money? Read on!

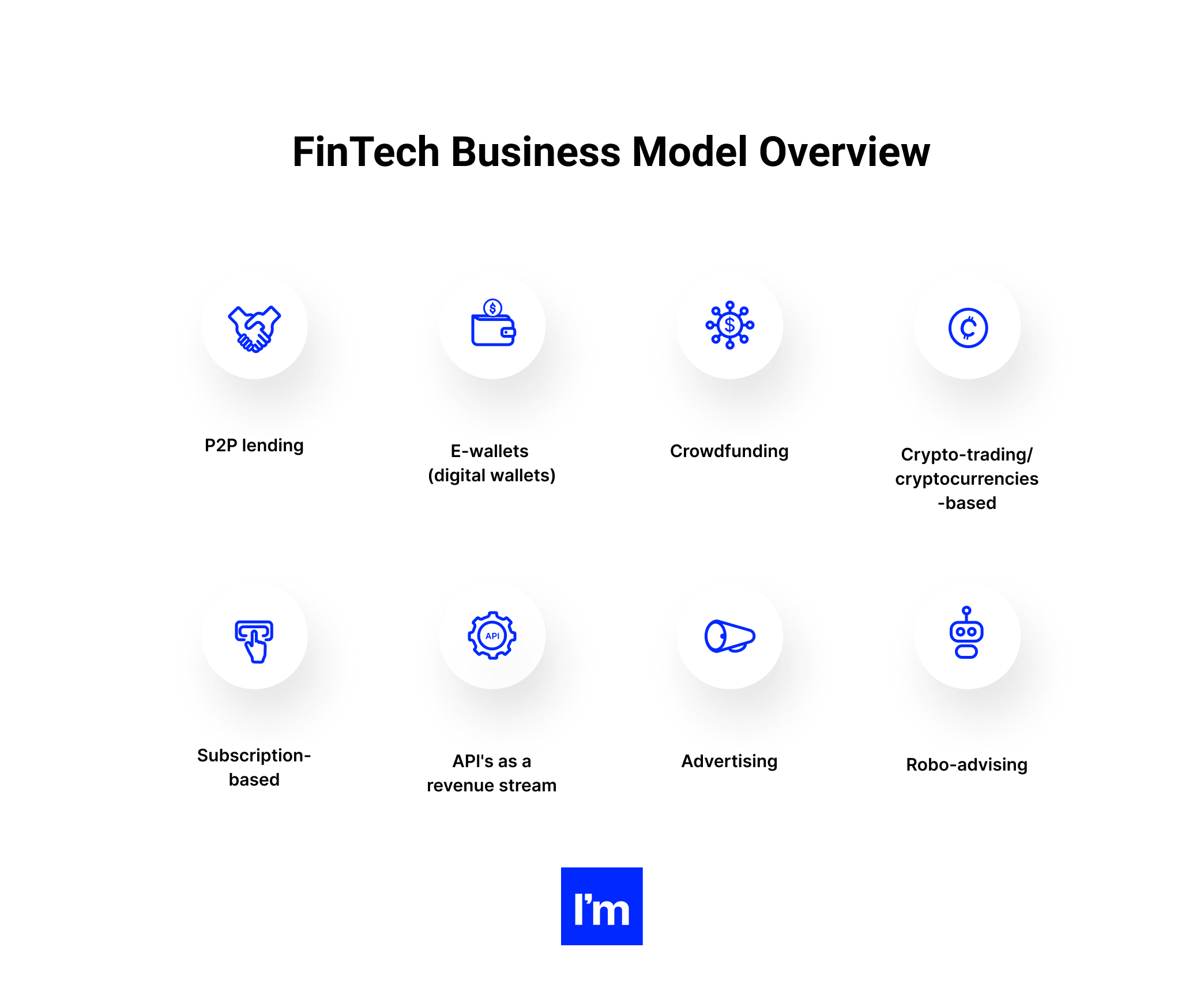

FinTech makes most of its money from subscriptions, third parties, and advertising. However, there are many more options for monetizing your product.

Since most FinTech companies are in their early stages, the majority is focused on growth rather than profitability. This is why you have companies like Monzo, which are valued at over $2.5 billion, and the most valuable FinTech startup, N26, at $3.5 billion, but they are not profitable. Neobanks that are at a later stage are already profitable, such as Starling Bank and Revolut.

Many do not understand the business model of FinTech companies, and many doubt that it will ever work. But in reality, this varies from FinTech company to company.

Therefore let’s have a look at the main ways of how FinTech makes money.

P2P lending

The FinTech software development market is booming and lending platforms are gaining momentum as well. Here we can distinguish between both lending platforms and P2P (peer-to-peer) lending solutions.

Through peer-to-peer lending, people can borrow money directly from other people, excluding intermediaries and financial institutions. With this model, people can earn interest thanks to the money they lend to others. Through these connections, FinTech software companies can earn commissions.

This model allows for higher yields than those offered in debt markets, making it easier to lend to investors.

By creating platforms that match different lenders to borrowers and charge fees on the repayment process, FinTech software companies can help optimize the commercial lending space. There are many applications that provide financial planning or management solutions for lending money, but there is still room for more.

Real-life examples include:

Nowadays, more and more students are opting for loans at a lower interest rate, which is expected to boost peer numbers. This FinTech business model is gaining momentum in regions such as Asia Pacific, North America, Europe, South America, the Middle East, and Africa.

Continuing about Africa, why not see our case study: building a financial Android app for investing and managing savings for an African market?

The largest P2P lending market is in North America.

If you are planning to develop an application with a P2P money-making strategy in mind, then you may consider developing your application in these regions for easy access to your target audience.

Luckily, outsourcing FinTech development offers an impressive business value nowadays. Some of the most prominent examples are:

- Remote work thrives

- Software developers’ rates continue to soar

- Onboarding an external team takes time

- You can capitalize on post-Covid-19 chaos

- Talent shortages persist, and they won’t go away

In our report, there are dozens of examples of why it's the best bet, especially when it comes to the CEE region. Find reliable proofs here - The State of CEE IT Outsourcing and Offshoring 2021 Report.

Want to see more reasons? Check out the next links:

Moreover, services of decent devs include:

- FinTech solutions powered by artificial intelligence and machine learning;

- Development of a platform for monetary transactions;

- Integration and optimization of payment systems;

- Web development and mobile FinTech development;

- Development of a platform for online trading and exchange;

- Discussing the most appropriate technology (spoiler: Python is the top choice here)

- Many many more.

E-wallets (digital wallets)

Electronic wallets are a combination of a simple bank account and a payment gateway. This business model allows users to preload virtual money into their e-wallets and use it to pay for goods or services. E-wallets are trending, and since the start of the pandemic, more and more people have started to take advantage of digital payments.

The digital payments FinTech companies business model provides customers with the convenience of making contactless payments for a small fee, which is primarily charged to merchants in the form of a merchant discount rate (MDR). These payment platforms also generate income from the sale of third-party financial services to their customers.

As there is constant innovation in the development of e-wallet applications, the cashless future looks very promising.

Successful e-wallet apps on the market are:

- Square Cash,

- Google Wallet,

- Samsung Pay,

- Venmo.

Crowdfunding

The concept of crowdfunding involves raising money to support projects or financial institutions. To make it easier to finance a product or project, smaller amounts of money are collected from a wider audience. This allows you to collect the required amount of money much faster than relying on only one investor. Although most crowdsourcing projects are conducted online, crowdfunding is also possible offline.

Crowdfunding takes many forms. An early access crowdfunding program can provide members with access to a beta version of a product or service in exchange for their input.

Usually, the money raised in this way goes to the development of a particular service or product.

Another type is profit sharing, where members transfer real donations in exchange for future earnings.

It is also possible to raise money through crowdfunding without expecting anything "in return." Donors can be genuinely happy to contribute to the growth of the organization.

There are FinTech businesses that grow through crowdfunding. Contributions to crowdfunding sites like Kickstarter or Indiegogo turn into products or services.

Several platforms support smaller authors, publishers, and characters, including Patreon, Patronite, and Buy Me a Coffee. Crowdfunding platforms usually make money by charging a percentage of the total funding raised.

Crypto-trading/cryptocurrencies-based

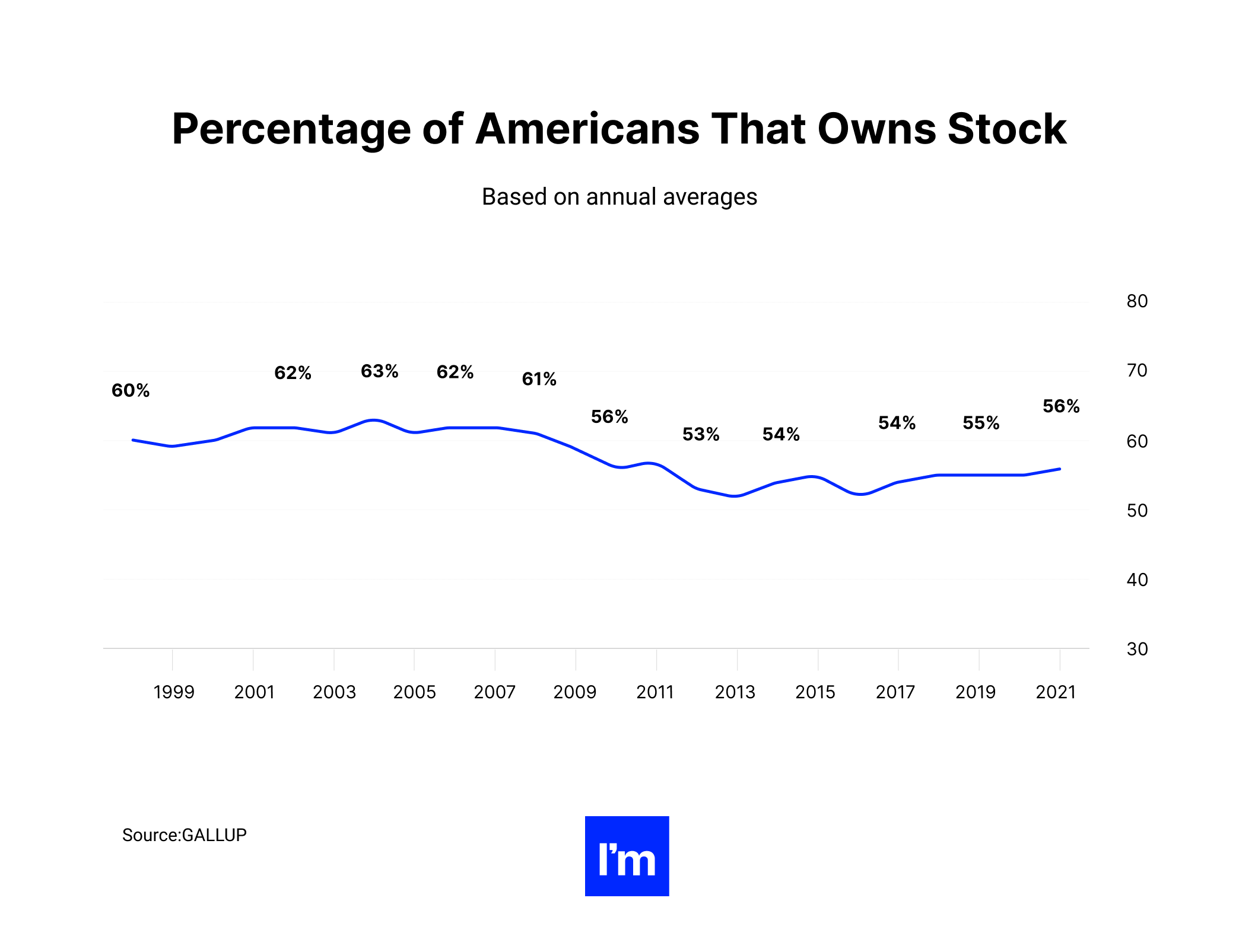

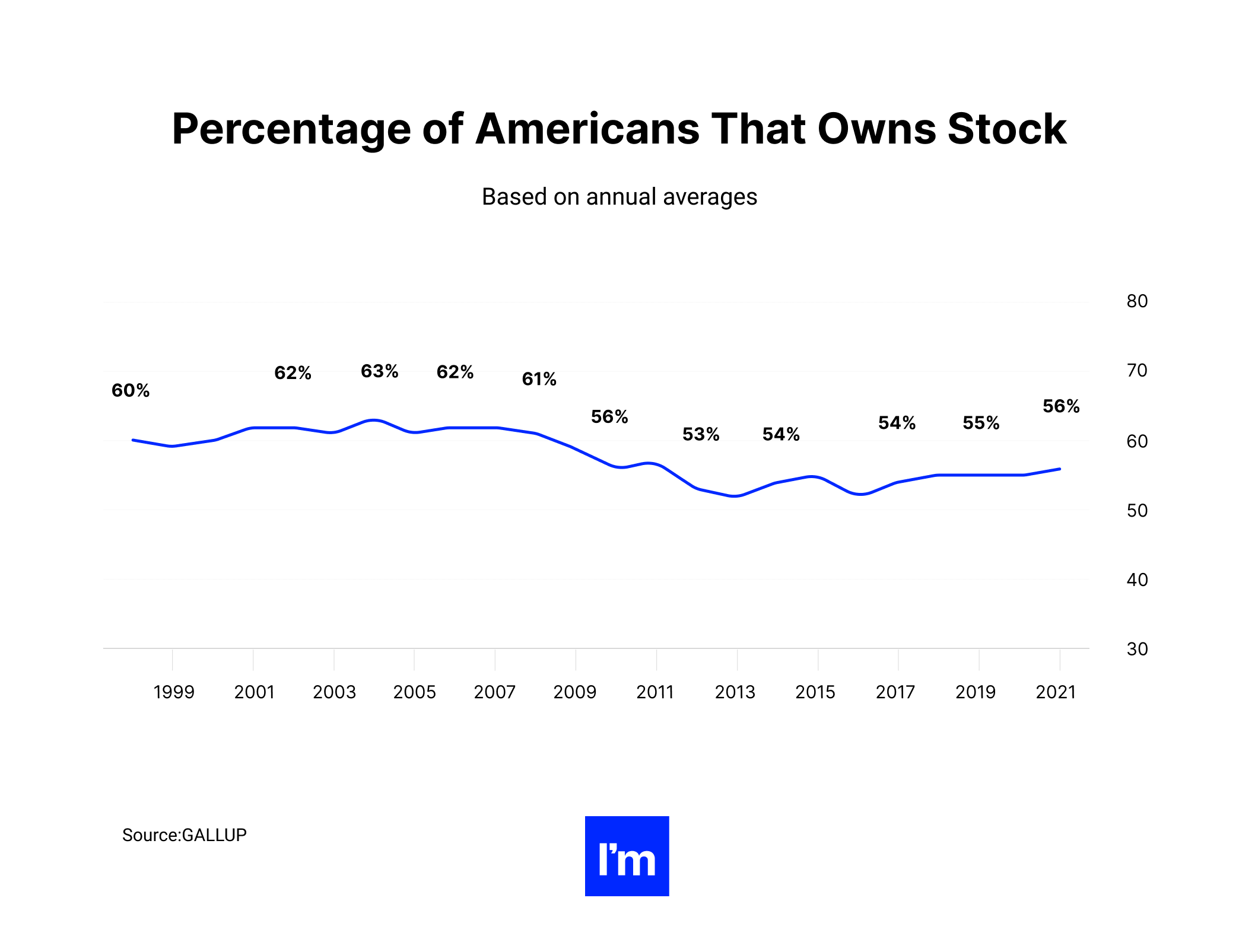

The next way of how FinTech makes money is through blockchain. A recent Gallup study reports that 56% of the US population owns at least one share, and a significant proportion of that share is actively investing in the stock market.

In addition, more than 13% of Americans started investing in cryptocurrencies in 2020, according to a study published by NORC, a research group from the University of Chicago report, and this number will grow in the coming years.

To be sure, the digital asset industry is booming, and now is the time for entrepreneurs to bet on this category of FinTech business models.

The simplest idea is to develop cryptocurrency exchange and adequately promote it among the target audience.

How will this business model of FinTech companies make money?

As with all asset exchanges, your business may also charge a commission for every trade a user makes. You can also offer users a referral commission for every referral user they refer.

Today, there is a whole world of assets that can be traded via a smartphone. Check them out, research your best rates and make a smart decision.

Subscription-based

The most popular approach to monetization for a FinTech company is the subscription model. Each client is billed a specific amount on a monthly, quarterly, or yearly basis. They also have a Freemium payment model where the customer gets access to the app for free for an unlimited time, but they have to pay a fee to access premium features.

These companies can also charge a flat transaction fee, which is usually between 1 and 4 percent.

Subscription is the safest way to make money. As a financial app, you can generate direct income from online users. Subscriptions are charged at a flat rate, so no interest planning or third-party integration is required in the app.

In short, the subscription fee is one of the most popular answers to your question about how FinTech makes money.

Not so long ago, Monzo digital bank launched Monzo Premium, a £15/month service fee that includes phone insurance, exclusive discounts, five free cash deposits per month, 1.5% AER interest on balances up to £2,000, and the possibility of withdrawing £600 + no commission in cash abroad.

API's as a revenue stream

With Open Banking, APIs not only allows data to be transferred more securely but also offer companies the ability to create products through partnerships. Thanks to Open Banking, FinTech A has created a rather interesting feature and can now sell it to FinTech B using the API.

The new business model of FinTech companies means they can sell licenses and code. Collaboration can mean revenue growth for all partners involved (including large banks).

But which web developers will build the apps and interfaces so that companies and financial institutions can securely share customer data? Whoever they are, they will make good money.

As a FIS Global white paper states,

"This area is fertile ground for productivity gains through new APIs."

Since Open Banking is fairly new and this revenue model is still fairly new, we bet?

Anyway, we believe that more and more FinTech companies will use this strategy to increase revenues.

This is how Banking-as-a-Service comes into play: FinTech companies can charge retailers and other companies to use their banking infrastructure, which is another source of income. This is an interesting development in the next few years.

Best examples on the market:

Advertising

Apps have become a source of digital advertising. It's pretty easy to use ads to monetize apps and make money. The app owner just needs to display ads on their mobile app and get paid from third-party ad networks.

In addition, you can get paid every time an ad is clicked. You can partner with selected lending firms, merchants, banking consultants to advertise in the development of your finance application.

As for this type of FinTech business model, your personal finance app can generate income through banner and multimedia ads.

- Banner Ads: These are the ones that appear on the main page of the application in the first place. They are mostly displayed in different sizes and at the top or bottom of the application screen.

- Multimedia Ads: These are interactive ads with various creatives, audio, video, text, images, or even mini-games. These ads do not force users to terminate the session, it does not affect the user experience.

To see some examples, find any 5 FinTech apps on the app store. Two of them will 100% have in-app ads.

Robo-advising

In short: robo-advisors are platforms for generating income from trading. This way, recipients do not need to pay investment advisors because the technology solutions manage their money automatically and they can also trade commission-free. These platforms use cutting-edge technologies such as AI and ML to effectively manage portfolios.

Find out more about the real value of machine learning engineers from our article - AI and Machine Learning Applications In Finance, FinTech, And Banking.

Also, you can come across some awesome solutions by reading Artificial Intelligence In Accounting - What Are Your Possibilities?

A portfolio management firm, for example, might charge a percentage of the total assets it manages. Advisory robot platforms provide the same services for a much lower commission, saving investors a lot of money.

For advice and fees on robotic insurance, users are not required to pay large sums but pay a portion of their assets as fees. Most investors find it more cost-effective to charge a certain percentage of their total assets.

Investors can still pay slightly more than the actual price of the stock, but the amount they set aside far exceeds the trading fees they would have to pay with conventional methods.

These trends highlight the growing popularity of online banking applications for online investing.

Bookmark How Machine Learning And Big Data Helps FinTech to dive deeper into this topic.

Here are some examples that fit this business model of FinTech companies:

Over to you

So, are FinTech companies profitable? The short answer is yes.

In fact, most FinTech companies in Asia and the US are profitable because they can rely more on exchanges (the commission that merchants pay companies like Visa Mastercard to accept card payments).

The problem of profitability mainly arises in Europe and the UK, where the exchange rate is low, and therefore FinTech companies must rely on other sources to increase their income.

Well, eight different models of income for FinTech companies. Some FinTechs adhere to one, some accept several, and some accept all.

Do they work?

This seems to be the case for some companies, such as Zopa and Transferwise.

Hope the info above was sufficient to convince you to either develop an application for yourself or learn more about FinTech.

With Ideamotive, you can launch a new web or mobile app for your business, rebuild a legacy system, get a sophisticated FinTech solution, or expand your engineering team with the help of our developers.

Whatever FinTech business model your business is following, Ideamotive talents are ready to help as we have mastered the latest financial technologies and have gained experience in creating reliable, secure, and sophisticated FinTech solutions and products.

Plus, you can rest assured that by partnering with us, you will partner with mobile developers who are experienced with FinTech development standards and constraints.

Let's talk about your FinTech opportunities!

Feel like entering the FinTech industry isn’t a piece of cake? Consider moving to marketplaces - Digital Marketplaces Business Models.

Technology is reshaping the financial industry. New FinTech startups are revolutionizing the market, speeding up the digital transformation of the biggest banking and financial companies. Leverage our experience and make sure you are the frontrunner of the race with state-of-the-art software solutions. Learn how Ideamotive FinTech experts can help you achieve your goals.